Why you can’t get your vacation three days before your vacation. Terms and specifics of payment of holiday allowance under the Tax Code of the Russian Federation Personal Income Tax in case of compensation for non-correspondent admission

The tax agent submitted to the tax authority the PDF document, under the hour of a desk review, any indication of an exemption related to the assessment and payment of the tax, as well as the situation of the untimely transfer to the budget of the amount of tax on income withheld from physical persons.

Pouch: on the right, it was sent for a new review before the court of appeal, since the court did not evaluate all the arguments of the partnerships

A stand for

a decision was made by issuing a new inspection about those who violated paragraph 1 of Article 210 of the Tax Code of the Russian Federation, the reporting base in the income declaration form 3-PDFO for 2016 was underestimated, as a result of incorrect allocation of income deducted from the repayment of bills of exchange. AT Oschadbank of Russia.Pouch: Having examined the materials of the certificate, analyzed the collections from the certificate, evidence and evidence

Dispute non-normative

the legal act was adopted by the tax authority after reviewing the materials of the visa tax re-verification. The basis for the filing of taxes on the added value, the penalty and the imposition of tax sanctions for incorrect payment of taxes in the form of a fine was the discovery of the tax authority about the understatement of the tax base by the Entrant due to the non-inclusion of the income withdrawn in For renting out non-residential premises All shipboard practice on the topic »Submitted income

The 3rd quarter is at its peak. Therefore, before the release of 6-PDFO for 9 months, it is important not to tell accountants how the final payments are displayed in the PDF-report.

Issues in 6-PDFO

In order to correctly fill out 6-PDFO for a portion of the output, it is necessary to understand if such income is deducted for PDF purposes and how much of this income may result in over-insurance of contributions to the budget.

So, holiday allowances must be withdrawn on the day they are paid, and taxes from these sums must be transferred to the budget no later than the last day of the month on which they were paid (clause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation) . In this manner, release the 6-PDFO for 9 months like this.

- For Section 1:

- on page 020, indicate the entire amount of holiday allowances (including PDF) paid for 9 months;

- At line 040 and 070, enter the amount of PDF from payments for 9 months of holidays.

- Division 2 has a 9-month expansion period; according to the legal rule, it is necessary to fill in as many blocks of rows 100 – 140 as the dates of payment of holiday allowances fell on the summer – spring. After all, the 30th of spring is a week, the term for payment of the PDF from the spring holidays falls already in the evening (01.10.2018). Apparently, information about the spring release and PDF from them can be used up to section 2 of the current 6-PDFO (FNP sheet dated 04/05/2017 No. BS-4-11/6420@).

In the rows themselves, say on the step:

- for banks 100 and 110 - dates of payment of allowances for linen and serpen;

- at the side 120 - "07/31/2018" - for linden exit tickets, "08/31/2018" - for sickle exit permits;

- at page 130 - a sum of lime/serpnevyh vidpusk;

- on page 140 - PDF with lipnevyh/serpnevykh vіdpusk.

As soon as there are holiday breaks

Since in the 3rd quarter, for whatever reason, there was a re-arrangement of the allowances paid in the 1st or 2nd quarter, then the amount of these sums in the 6-PDFO lies due to the fact in which case the re-arrangement occurred (Sheet of the Federal Tax Service for the Moscow City Region, no. 12 .03.2018 No. 20 -15/049940). If after the changeover the amount of allowances has increased, then display the statements about it in sections 1 and 2 of the 6-PDFO breakdown for 9 months (after the culprit, if the changeover occurred in the spring represent the overflows by analogy with the vernal outlets). If, as a result of the reorganization, the allowance amount has changed, then the employer will have to submit an update for the period for which the final allowance amount was changed.

Do not mislead admission fees and compensation for inappropriate admission

Regardless of the fact that such compensation is paid to workers who are paid for days off work, there is no allowance. І for PDF purposes, compensation for non-existent release is considered to be deducted from the remaining day of work of the employee who is due (Clause 2 of Article 223 of the Tax Code of the Russian Federation). And the contribution from this compensation must be reinstated no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation). In accordance with these particulars, information about the amount of compensation paid and the contribution for it must appear in 6-PDFO.

Likarnyany in 6-PDFO

Information about the amount of paid assistance due to timely inefficiency and the PDF for them is displayed in 6-PDFO in a manner similar to the procedure for displaying release notes.

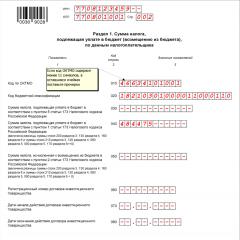

In field 107 of the payment order, indicate the deposit period during which the deposit and deposits are paid. From field 107 it may be clear for what period the tax is paid. Also in field 107 you can indicate a specific date. Recently, the Federal Tax Service issued a sheet dated July 12, 2016 No. ZN-4-1/12498, which stated that a payment must be filled out for the payment of the PDF to the filing agents. Why is field 107 now visible under the new rules for filling in payments? Can you continue to fold one payment? Let's get along.

Entering information

Filling in field 107 is required to indicate the frequency of tax payment or the specific date of payment of the tax payment, since such a date is established by the Tax Code of the Russian Federation (clause 8 of the Rules, approved by order of the Ministry of Finance of Russia dated November 12, 2013 at No. 107n).

Field 107 contains a 10-digit code for the tax period. The first two signs indicate the period for paying the tax. For example, for quarterly - KV, for thousand - MS, river - GD.

The fourth and fifth sign is the number of the tax period. For example, if the tax is paid for the serpen, it is written “08”.

The signs from seventh to tenth signify rik. The third and sixth signs will always have speckles. For example - KV.03.2016.

New explanation of FNP about field 107

The FNP sheet dated July 12, 2016 No. ZN-4-1/12498 informs that the filing agent must put together a number of payment orders that are being reinsured by the PDF with different payment terms.

Thus, the FNP essentially recommends new rules for filling out payment documents starting in 2016. There were no such people on the side of the donors before. However, after these recommendations appeared, accountants started talking about those that fit in field 107.

What should you tell us now in field 107

When paying PDF documents, the law establishes a number of lines for payment and behind each term there is a specific date of payment.

Butt axis.

PDF from salary

PDF from wages, bonuses and material benefits must be transferred to the budget no later than the day following the day of payment of income (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation).

butt.

The salary for the linen was paid to the workers of the labor force on September 4, 2016. In this case, the date of taxation was 31 lindens, and the date of tax collection was 4 sickles. And the remaining date, if the PDF is to be re-insurance to the budget, is September 5, 2016. What does this mean that you need to put 08/05/2016 in the payment?

In field 107 of the payment order you can enter “MS.07.2016”, so that it is clear what the tax is for the linen?

PDF with medicines and release documents

PDF, with help due to the time-consuming inefficiency, help with looking after a sick child, and reporting from holidays, it is necessary to re-insurance later than the remaining date of the month for which the income was paid (paragraph 2, paragraph 6 Article 226 of the Tax Code of the Russian Federation).

butt.

The spivorbitnik is released from September 25 to June 15, 2016. The graduation fee was paid to him 15 serpnya. In this case, the date of deduction of income and the date of deduction of the PDF is 15 September, and the remaining date, if the tax is due to overinsurance to the budget, is 31 September of 2016. Would it be correct for field 107 to include payments for the PDF payment on 08/31/2016? Why enter “MS.08.2016”?

The rules for filling out payment orders do not have an unambiguous explanation for these requirements. Therefore, we can express our thoughts about how new recommendations can be made, based on the FNP sheet dated July 12, 2016 No. ZN-4-1/12498.

Our thought: save your income for a month

We appreciate that it is not necessary to indicate a specific date on payment orders. Moreover, for everything, it is important for the tax inspectors not to collect a lot of information about different dates, but to understand for what period the PDF was paid and check it with the 6-PDFO structure. And if so, then accountants, in our opinion, need to go into hiding for a month, since they have a source of income.

To determine which month the PDF is due, focus on the date of recognition of income under Article 223 of the Tax Code of the Russian Federation. For example, for wages the remaining day of the month, for which you see pennies. For holidays and medicine - the day of payment (Article 223 of the Tax Code of the Russian Federation). Let’s explain with the butts and symbols of the payment.

Salary fee

According to paragraph 2 of Article 223 of the Tax Code of the Russian Federation, it is stated that salary becomes income on the remaining day of the month for which it is charged (clause 2 of Article 223 of the Tax Code of the Russian Federation). Then write in field 107 the month number for which the salary was paid. It is acceptable that the accountant adds up the payment from the PDF from the salary for the serpen. Todi has 107 wines, including “MS.08.2016”. They don’t care about those that the payment is due in the spring. And so, in our opinion, it will be correct.

Holidays

The allowances become income on the remaining day of the month to whom they were paid (clause 6 of Article 223 of the Tax Code of the Russian Federation). For example, if you pay the holiday allowance to the worker at the beginning, then in field 107 of the payment for the payment of the income tax, enter “MS.09.2016”. As soon as you let go, go to the zhovten.

Licarnians

Holidays become income on the remaining day of the month to whom payment is made (Clause 6 of Article 223 of the Tax Code of the Russian Federation). For example, if you pay a worker’s holiday in 2016, then in field 107 of the payment you need to fill in “MS.10.2016”. And we show that the exit payments were paid in the tenth month of 2016.

Material benefit

Sometimes, among medical workers, income comes from the appearance of material wealth, for example, from the position taken. In order to reclaim the income tax from field 107 of the payment order, repeat the month on the remaining day on which the person has a material benefit. For example, if there is a material benefit from cultivating the position of Vinyl in leaf fall 2016, then fill in field 107 like this:

Borg extinguishment: field 107

Fill in field 107 for the supply agents as required by the situation if the borgs from the PDF are being repaid. If the organization is extinguishing the debt through a free initiative (voluntarily), then in field 107 enter the month during which the debt is being repaid. In field 106, enter the PO code. This code is significant because it is a continuous payment, the very repayment of the debt. For example, if you are repaying debt from PDF for the 2016 quarter, then add the payment as follows:

How to remember field 107 in ambiguous situations

Now let's take a look at a number of broader situations from the completion of field 107 during the re-insurance of the PDF.

Situation 1. Salary and holiday pay overnight

The same organization immediately received a salary for the day and the same day of holiday.

Decision. Before the salary, the date of income is the last day of the month for which the money is charged. For graduation, the day is the payment of pennies. Therefore, you need to fold two payments. In field 107 for salary contributions, enter “MS.07.2016”, and in field 107 for salary payments, enter “MS.08.2016”. This way, the tax for which month you are submitting will be clearly understood. And this approach is consistent with the new recommendations of submitters.

Situation 2. Salaries and doctors overnight

In the spring, the organization immediately issued salaries for the same day as holidays.

Decision. Before the salary, the date of income is the last day of the month for which the money is charged. For holidaymakers - this is the day of payment of the fees. Therefore, you need to fold two payments. In field 107 for salary contributions, enter “MS.08.2016”, and in field 107 for salary payments, enter “MS.09.2016”.

Situation 3. Vacation dates for another month

Decision. Before graduation, then the date of income is the same day as the payment of pennies. It doesn’t matter what month the holidaymaker sleeps. Therefore, in field 107 of the payment for the re-insurance of the PDF from the release notes, enter “MS.08.2016”. To show you what you saw during the spring of 2016.

Situation 4. Salary and bonus overnight

Situation 5: pay contractors

The contractor at Versna was given wine to the city for his services, given at the Serpna.

Decision. The date of receipt of income under a civil law agreement is the day of payment of pennies. This day I fell on the verdure. Therefore, in the payment form for payment of PDF in field 107, write “MS.09.2016”.

Situation 6: add

The sickle worker has withdrawn the above-normative supplements associated with his work. From them, follow the PDF. The advance notice for refurbishment bags was confirmed in the spring of 2016. The tax was withheld from the spring salary.

Decision. The date of deduction of income for above-standard extras is the remaining day of the month in which the advance payment for repayment was confirmed (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). In terms of salary, the date of income is the last day of the month during which pennies were earned (Clause 2 of Article 223 of the Tax Code of the Russian Federation). So in both cases the last day of the month. So, in our opinion, you can put one payment in field 107 meaning “MS. 09.2016". Even the tax collectors in their explanations did not talk about those who, on separate payments, then divide the tax in the same terms of payment.

Visnovki

Among accountants, there is also the idea that after the FNP sheet dated 07/12/2016 No. ZN-4-1/12498 appears on payments, specific dates must be entered, not later than any organization or individual entrepreneur can pay the PDF. For example, it is necessary to transfer the PDF from the release notes issued in the spring before the end of the month. Therefore, in field 107, when paying PDF with admission documents, you need to put “09/30/2016”. Re-invent the PDF from the paid salary on the due date. If you received your salary on, say, the 5th of Wednesday, then in field 107 you need to enter the coming day, then “09/06/2016”. This option is also valid. Moreover, it cannot be excluded that it is true and does not raise a claim on the part of the Federal Tax Service. Unfortunately, there is no official explanation for this yet.

In our opinion, before we praise the remaining decision about those who write in field 107, it still makes sense to seek clarification from your Federal Tax Service. However, in any case, please be respectful: inspectors do not have the right to fine the tax agent or charge penalties if the tax was paid to the line and the payment went to the budget.

Moreover, as a filing agent, it is permissible that, having paid wages and holidays on the same day and having filled out one payment order, it is not possible to respect the damages or make peace, if the payment is expected to reach the budget for the correct KBK. Div. In this case, we repeat that the submitters, who paid for everything, plan to combine the data from field 107 with the 6-PDFO regulations. And if the filer program can identify insurance and over-insurance payments, the inspectorate can ask for clarification, ask for clarification of the rules and payment details.

Release from the 1st day of the month for 1C: Salary and personnel management 8th edition 3.1

The situation, when a student leaves the holiday from the 1st day of the month, is often asked by our clients and readers: the holiday must be paid 3 days before the start of the holiday, in advance I have not yet paid for the month, and the wages have not been raised, and this month may still be inclusions to the middle level. Previously, I wanted my clients to simply re-examine the release document after the remaining salary distribution for the previous month, but with the advent of 6-PDFO, the situation changed a little.

Let's take a look at the example of the 1C program: Salaries and personnel management 8th edition 3.1. To pay off allowances, go to the “Salary” tab and select the “Allowances” item.

We add a new document and carefully fill in all fields. The release starts on the 1st month of the month, the payment date is the 28th of Wednesday, as the month of payment is collected on Wednesday.

Once we take a look at the breakdown of the average salary, we can see that the monthly salary has not gone down that much.

The workers are paid in the same amount as they were insured for this document, then they are charged and paid the salary for the spring.

After data appeared about wages for the spring, the release requirements were reinstated. Until 2016, you could simply go to a previously created document, open it again, and pay additional wages in sums if your average salary increased. With the arrival of 6-PDFO, the situation has changed: now we calculate and pay PDFO based on the dates of withdrawal of income, taxes from the release of insurance premiums on the date of 28 June, then withholdings and reinsurances to the budget, then now PDFO It's too much to overreact. If the amount of allowances increases, and this change appears to be the same date of withdrawal of income, then it turns out that we have not paid taxes to the budget, then we need to act differently. We open the release document again and place it on the lower left corner of the form.

In this case, when the salary for the previous month has been covered and paid, the document appears with a message “Correct” and a preliminary note about those who make changes before the current document is not recommended. And the command “Correct” is just right for our purpose. When the message is received, a new document is created, in which the final salary balance is re-arranged, the previous one is reversed and a new one is created, with the balance of the remaining salary structure in place.

In our group, the average income has increased, the difference in the sums of the graduates is promptly paid to the student, and the date of deduction of income, as shown in 6-PDFO, will be another number - 5th.

How to open up holiday permits, as of the 1st day

The organization's health certificate will be released from the 1st day of the coming month. In accordance with the law, the release date may be transferred 3 days in advance to the beginning of release, then. at the current month. When transferring vacation pay to the average salary, there is no data for up to a single month (we like it). Nutrition: In which month is the accountant responsible for obtaining an allowance, and in which month is it necessary to re-insure this allowance in order to withdraw or pay additional allowances?

The peculiarity of the situation is that on the day of payment of vacation pay you still have no information about your salary for the remaining month of the payroll period.

Let’s say the doctor is on leave from the 1st quarter of 2016. The growth period from the 1st quarter of 2015 to the 31st of February 2016 (clause 4 of the Regulation on the specificity of the procedure for calculating the average salary, approved by the Decree of the Russian Federation dated December 24, 2007 No. 922).

When to pay holiday allowances and how to pay them

You must pay holiday allowance no later than the 29th of February. You cannot overpay your holiday payment. Let us know 29 Bereznya You don’t have any residual data about the salary for Bereznya.

Recover the average daily earnings from payments for the period from the 1st quarter of 2015 to the 29th of 2016. Pay the sick leave amount.

When the maternity season is over, celebrate your holidays again. Get your salary for the berezen. If the new sum turns out to be larger for the cob, re-insure the surcharge for the holiday allowance.

Disbursements from PDF with the primary sum of the release notes

For the PDF, it is important which day you paid the workers' leave allowance. The day of their announcement is not important for the PDF. This reduces the PDF for income tax, insurance contributions and the procedure for the receipt of expenses from the bookmaker.

The day of withdrawal of income is the same day of payment of allowance (Clause 1 of Article 223 of the Tax Code of the Russian Federation).

The day of the morning of the PDF is the day of payment of allowances (clause 4 of article 226 of the Tax Code of the Russian Federation).

The term for payment of the PDF is the later of the remaining day of the month for which the allowance was paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Table 1. Dates from the PDF with the first sum of release notes

Read also: Fuck you for not paying your wages

Date of re-insurance of the release date

Release of the coming month, release of the current month

Church workers are preparing for the start of the new month. In order to pay your holiday allowance, the law requires you to pay it in advance - three days before your release. How to arrange insurance deposits, PDF and information, we will talk with the statistics.

How to deal with the health workers who are looming for the release of the new month

If a worker is about to leave the new month (at the beginning), it will inevitably turn out that he will need to pay his holiday allowance even before the end of the previous month. They must also be found guilty no later than three calendar days before the start of release. The term three days of prescriptions in Statute 136 of the Labor Code of the Russian Federation. And Rostrud has a list dated 30 June 2014. No. 1693-6-1, noting that this article refers to calendar days.

For example, the outlet starts with 1 liner. Well, it’s necessary to overhaul the outlets as much as possible. But let’s not even talk about those that don’t need to be turned on during the growth period. Well, let's say, the clerk is waiting for 29 and 30 cherches, so after paying his leave allowance. They can be over-inflated.

And it’s not obligatory to pay the salary at the same time for redundancy. It can be paid at the term established by the company.

You can turn on allowances from the 1st day of the month at the stage of preparing the allowance schedule. You won't be able to over-invent anything, no matter what. But in practice it is never more possible.

Release of the coming month: PDF

As of 1st September 2016, there is a new rule - you must re-insure PDF from the release notes no later than the remaining date of the month in which you paid them to the employee. If it is a day off, it will not be later than the next working day. The contribution must be withdrawn, as before, at the time of payment. This rule applies to short periods of time and transitional breaks. For the PDF, what is important is the date of payment (subclause 1, clause 1, article 223, clause 6, article 226 of the Tax Code of the Russian Federation).

butt. Release of the new month: PDF regulations

The company clerk is at the exit from 1 line. You will need to see your graduation dates later than 28 cherubs. The accountant handed them over to the graduate on the 28th of the same day, re-secured the release notes and lost the PDF from them. And the tax itself paid up to the budget of 30 rubles.

The allowance amount was 34,561.11 rubles. PDF for this amount - 4493 rubles. The company does not create a reserve for releases until small amounts. Conducted in the form will be like this.

28 chernies:

DEBIT 44 CREDIT 70

- 34561.11 rub. - release documents have been arranged;

DEBIT 70 CREDIT 68 subrahunki “Rozrahunki z PDFFO”

- 4493 rub. - prepared by PDF;

DEBIT 70 CREDIT 51

- 30068.11 rub. (34,561.11 – 4493) – over-insurance of the worker’s allowance minus the PDF.

30 worms:

DEBIT 68 subrahunki "Rozrahunki z PDFO" CREDIT 51

- 4493 rub. - PDF with release notes paid to the budget.

Є food

The priest asks for permission to enter the next day. Don’t mind kerivnitstvo. When does this happen when the PDF is over-inflated?

It is necessary to check the date of payment of the allowance. For the PDF, it doesn’t matter whether they violated the payment of the final permit “no later than three days” or not. For example, spivrobitnik 4 linden after a release from 5 bereznya. The outlets were re-raised by 4 linden trees. Well, why the day do you waste the PDF, and you can re-settle the tax any day before the end of the day.

Release of the coming month: insurance contributions

Insurance deposits are required to be insured as soon as the payment itself is insured (Article 11 of the Federal Law dated June 24, 2009 No. 212-FZ). No later than three calendar days before the start of release. If such a day falls on the previous month, then the holidays must be included before the start of this month (sheet of the Ministry of Industry of Russia dated June 17, 2015 No. 17-4/B-298). And you can take the same amount of deposits from that same month during the distribution of the income tax. The Ministry of Finance respects this very way (sheet dated 1st chernia 2010, No. 03-03-06/1/362).

The same procedure must be enforced for violating the terms of payment of holiday allowances. If a student asks for leave from tomorrow, make deposits for the same month as the leave. According to the Labor Code, you were not allowed to pay them last month.

Let’s say the holiday pay goes to the outlet at the lipnya, and the release payments go to the black one. If you collect deposits from the same month in which the release begins (at the time), you can end up with funds that need to be verified. They stink to call the company at the lowered prices. And if the permits are issued in one quarter, and the release is repeated in another quarter, you may face not only a fine, but also a fine.

Reinsurance of insurance deposits is required no later than the 15th day of the month following when the deposits were collected (sheet of the Federal Insurance Service of the Russian Federation dated 16 April 2014 No. 17-03-09/08-4428P). Today, as a rule, there is no risk of injury.

butt. Unraveling of insurance deposits for transitional releases

Vikoristovu is thinking about the front butt. Conducted by an accountant who earned 28 rubles:

DEBIT 44 CREDIT 69 subrahunki “Rozrahunki z PFR”

- 7603.44 rub. (RUB 34,561.11 × 22%) - contributions to the Pension Fund have been adjusted;

DEBIT 44 CREDIT 69 subracks “Rozrahunki with medical insurance”

- 1762.62 rub. (RUB 34,561.11 × 5.1%) – contributions from health insurance have been collected;

DEBIT 44 CREDIT 69 sub-banks “Debits from social insurance for the occasional unavailability and in connection with motherhood”

- 1002.27 rub. (RUB 34,561.11 × 2.9%) - contributions to the Federal Social Insurance Fund of the Russian Federation were added;

DEBIT 44 CREDIT 69 sub-banks “Results from social insurance in case of accidents in the production sector”

- 69.12 rub. (RUB 34,561.11 × 0.2%) – modification of the contribution for injuries.

The accountant transferred the deposits from the release documents to the company's warehouse for redundancy. The last term is 15 years.

Holidays for the coming month: appearance of holidays

When decomposing the arrivals, the output track is included in the warehouse and expenses are proportional to the days of release, which fall during the different periods. Such positions are maintained by the Ministry of Finance of Russia (sheets dated May 12, 2015 No. 03-03-06/27129, dated May 9, 2014 No. 03-03-RZ/27643). The arguments of the practitioners of this department are as follows.

The allowance is paid until the payment for the payment (Clause 7, Article 255 of the Tax Code of the Russian Federation). And yet you pay - it’s the same salary itself, only seen in advance. Therefore, before the release, a fundamental principle is established: they are recognized at the depository in the due (tax) period in which they are due, regardless of the date of actual payment (clause 1 of Article 272 of the Tax Code of the Russian Federation).

For example, in the organization of the winter period from filing income - the first quarter, including nine months. If worms and linden grow in the outlet, then the outlets need to be divided. The sum of the allowances that is due until the chert is included before the expenses for payment. And the lime part of the outlets will be modified in the video data in 9 months. Then, if you spend something, you will be insured, or later.

butt. Submission form of transitional outlets

Vikorist is thinking about the two front butts. The release of the sprouting plant starts at 1 line. So, the entire amount of the allowance must be included before spending in the third quarter. With this amount of insurance deposits, they can be taken from the first insurer.

Read also: Short working day

At the bukhoblok, the accountant turned on the spending of the ruble. If the company's fragments are kept to small amounts, there is no need to display time differences in the form.

At the same time, according to the legal management of the FNP of Russia, during the expansion of the income tax, the allowance can be taken one-time at the same time in which the payments were made (sheet dated 6 February 2015, No. 7-3-04/614 ). On this list, the Federal Tax Service's representatives also rely on the arbitration practice that has developed on par with the FAS, which clearly supports such an approach. For example, according to the decision of the Federal Antimonopoly Service of the Zakhidno-Siberian District on November 7, 2012. at the reference No. A27-14271/2011 and dated 26 April 2011 at reference No. A27-6004/2011. However, the Ministry of Finance still has other positions to consider. Also, you will lose your check if the officials change their minds. Or a decision will be made to the Supreme Court regarding the benefit of the companies.

If the supply falls entirely on one quarter, then there is no demand for the distribution section. Even if you spend any time, your expenses will be fully indemnified. The culprits of this rule are organizations that contribute to the income of the population. It is your responsibility to spend money on the release, so that you can move on to the coming month, in case of any emergency.

There is no need for a booze store to distribute its output by month. It doesn’t matter whether you pay for the reserve account or pay for the deposits. Accounting rules do not apply to such matters. І rakhunok 97 “Waste the future periods” there is also no need to vikorist. Adje tse is in-line, not the company's mayday. Moreover, the release notes do not in any way reflect the concept of the asset. And the surplus behind rack 97 is included immediately before the asset balance sheet. Let me remind you that the company, because it does not have to pay as much as possible, is in the process of forming a reserve for future payments for releases (clause 8 of PBO 8/2010).

Dear colleague, Kostyantin Ivlev has prepared a gift for you!

Make an advance payment to Golovbukh with a steep decline then take the mixer away from your gift! Savings for your company's warehouse from 10% to 40%!

Shvidshe press the “Rozdrukuvati rakhunok” button. A large number of prepayments have been reduced!

Registration of permits, such as release from the 1st

In which month does the salary account include the amount of increased allowances, since the beginning of the allowance falls on the 1st day? For example: release from 03/01/2016. Before growth includes 12 months prior to release of the cob. from 03/01/2015 to 02/29/2016. Because The outlets may be seen no later than 3 days before the beginning of release, without the need to handle anything (salary for any amount of time ahead there is no possibility to grab the sprout in the Polish region). We are in the process of re-arranging the release date without re-arranging the salary, and after re-arranging the salary for the hard time, we are afraid of re-arranging the release date. Everything has become clearer here. Meals, in which month should the holiday allowance be included? And even the payment for them is crushed in the fiercest way, and the overflow from the birch tree, and the cob of release from the birch tree?

You include the amount of the allowance from the salary of the month in which you pay this amount. So, as soon as the release of the new crop begins on the first day of pregnancy, it is clear that the release of crops is due no later than 3 days before the start of release, then in winter.

In whose case do you get the permits from the fierce one? You can beat this operation from a drunkard as well as from a fierce one. If you are a small business and do not create reserves to pay for expenses, then you can use the entire amount of expenses to pay for your expenses. They don’t care about those who will have access to the birch tree. On the right, as of 2011, it may not be possible to spend money on the balance sheet as it will be possible to spend money on future periods (along the lines of a row). respond (clause 65 of the Accounting Regulations, approved by order) . Ministry of Finance of Russia dated July 29, 1998 No. 34n).

In such a situation, it is also necessary to collect the insurance contributions from the premiums if the insurance premiums themselves have been paid (Part 1, Article 7 and Part 1, Article 11 of the Federal Law dated July 24, 2009 No. 212-FZ and the Ministry of Industry of Russia dated 04.09.2015 No. 17-4/Вн-1316.від 08/12/2015 No. 17-4/ОOG-1158 and issued 06/17/2015 No. 17-4/В-298).

Once upon a time, you have already understood that the health workers have collected less holiday allowances as needed, and you will also receive an additional payment from the bereznia. Then, indicate the amount of the surcharge from the departmental statement for the pregnancy, make accounting entries from the bank and collect the insurance deposits for the surcharge for this month.

If you consider the simplified tax system to be based on income minus deductions, then you have the right to include the amount of paid allowances in deductions on the date of payment of the money to the pensioner (subclause 6, clause 1, article 346.16 and subclause 1, clause 2 Article 346.17 of the Tax Code of the Russian Federation) .

What about food? Our experts will help you in 24 years! Unsubscribe from New

Release on the 1st of the month, which is the month

Still, please, if anyone knows, tell me what month to get the permit, when the 1st quarter began, and how the 25th of February was paid for in advance, in which legislative acts this is covered. because I am insurable in the city, simply because it is Kvitneva, and simply because on the 25th of March I don’t have an unsecured salary, so that the permit is insured correctly, and simply because I need to sweat We will not overinsure neither the allowance nor the savings salary ( Raptom worker from 25 pregnancy to 31 pregnancy illness or without replacement (how do you know everything that is so important for holidays?) Menu is easier when paying In the case of a bank salary, the amount of paid holiday allowances is not covered; when paying a bank salary, I also the insurance company, that the pieces of paper have already been paid and the excess is paid.

from Yandex:

Good afternoon.

From the station to the station. 136 of the Labor Code of the Russian Federation, payment of permits must be made no later than 3 days before the start of release. When the vacation starts on the 1st day, a situation arises where at the time of the start of the vacation there is no information about the amount of wages for the previous month.

Regulatory acts of postponing the rozrakhunkovogo period are transferred in such cases. If the worker does not receive the actual paid salary during the busy period, or at any time this period is completed in an hour that is included from the discharge period. In this case, the average salary is calculated from the amount of the salary during the period, which is transferred to the rozrakhunkov. In other cases, there are no reasons for postponing the dehiscence period.

There are other possible options.

Pay holiday allowance before the end of the payroll period in the amount of average earnings. In the coming month (if the new month is actually with the mother), you can make a repayment of the sums accrued in the remaining days of the new month. after the actual payment of the allowance. At the same time, with the payment of your regular salary, you will pay an additional payment of holiday pay.

Another option for settling down to a singing peace is by trusting your health professional. You will pay your salary in advance until the end of the month, so that by settling the exact amount you can pay the exact amount of your holiday pay without any further adjustments. In this situation, you risk that if the worker falls ill just before release, you will have to re-handle the release amounts in exchange for changes in the amount.

All people are like people, and I am a queen)

I have two shortcomings: a bad memory and something else.

Release from the 1st day of the month for 1C: Salary and personnel management 8th edition 3.1

The situation, when a student leaves the holiday from the 1st day of the month, is often asked by our clients and readers: the holiday must be paid 3 days before the start of the holiday, in advance I have not yet paid for the month, and the wages have not been raised, and this month may still be inclusions to the middle level. Previously, I wanted my clients to simply re-examine the release document after the remaining salary distribution for the previous month, but with the advent of 6-PDFO, the situation changed a little.

Let's take a look at the example of the 1C program: Salaries and personnel management 8th edition 3.1. To pay off allowances, go to the “Salary” tab and select the “Allowances” item.

We add a new document and carefully fill in all fields. The release starts on the 1st month of the month, the payment date is the 28th of Wednesday, as the month of payment is collected on Wednesday.

Once we take a look at the breakdown of the average salary, we can see that the monthly salary has not gone down that much.

The workers are paid in the same amount as they were insured for this document, then they are charged and paid the salary for the spring.

After data appeared about wages for the spring, the release requirements were reinstated. Until 2016, you could simply go to a previously created document, open it again, and pay additional wages in sums if your average salary increased. With the arrival of 6-PDFO, the situation has changed: now we calculate and pay PDFO based on the dates of withdrawal of income, taxes from the release of insurance premiums on the date of 28 June, then withholdings and reinsurances to the budget, then now PDFO It's too much to overreact. If the amount of allowances increases, and this change appears to be the same date of withdrawal of income, then it turns out that we have not paid taxes to the budget, then we need to act differently. We open the release document again and place it on the lower left corner of the form.

In this case, when the salary for the previous month has been covered and paid, the document appears with a message “Correct” and a preliminary note about those who make changes before the current document is not recommended. And the command “Correct” is just right for our purpose. When the message is received, a new document is created, in which the final salary balance is re-arranged, the previous one is reversed and a new one is created, with the balance of the remaining salary structure in place.

In our group, the average income has increased, the difference in the sums of the graduates is promptly paid to the student, and the date of deduction of income, as shown in 6-PDFO, will be another number - 5th.