Receiver's rizik: its essence, its peculiarities in Russia. Types of enterprise risk Entrepreneurial activity is associated with financial risk

The first classification of enterprise risks is presented in the words of J. Keynes. In my opinion, the value of a product must include the amount of losses associated with increased depreciation, changes in market conditions and prices, as well as losses due to accidents and catastrophes, which are called losses risks necessary to compensate for the actual sales of goods from estimated size.

J. Keynes said that in the economic sphere there are three main types of business risks.

Right in front of us, right? risk of acceptance chi postalnik. This type of risk arises only if money is directly put into circulation and one doubts whether one will be able to fairly reap the benefit that one pays for insurance.

Another type of host riziku - creditor's rizik. It occurs where credit operations are practiced, and is associated with the doubtful grounding of the trust in the case of immediate bankruptcy and the attempts of the debtor to manage to settle his claims. It is doubtful whether one can also question the sufficiency of the provision of a position in the event of the temporary bankruptcy of the employer, if the recovery of the transferred income does not happen.

The third type of accepting riziku - inflation risk. In connection with possible changes in the value of a penny unit, it allows you to make a refund about those whose penny position is less reliable in the future, and less likely. In addition, inflation has a negative impact on invested capital (especially in the long-term perspective) and puts debtors at the preferred level with creditors.

In the opinion of J. Keynes, all these types of economic risks require forward-looking and clear assessments.

With the basic understanding of the sphere, the classification of admission risks differentiates between admission risks and the system of admission risks. The remaining understanding is much broader: in addition to the power of the enterprise risks, there is also the nutritional management of the risks, the insurance of the enterprise risks, the division of the risks between the subjects, the change of the risk minds and others.

In general, the receiving areas are divided into areas on the national level (between the economies of one country) and international areas (between the economies of different countries).

Risks on the national level include:

- risks on the macroeconomic level that will burn the economy;

- risks on the microeconomic level that exist around various manufacturing enterprises, installations, organizations or physical characteristics.

Let us focus first on the characteristics of the economic risks of the macroeconomic level.

Among such risks one can see foreign powers and local ones. The subjects of the foreign-power rizik are the most important organs sovereign power. The concept of local rizik is associated with these more private, specific tasks and manifests itself at the Galuzev and regional levels of state governance.

In general, the development strategy of the country, the adopted concepts of transformation, the choice of different options and priorities in the development of the country are due to the development of a development strategy. The importance of priority areas is the main one at this time, as a result of the transition from a strictly centralized control system to the development of a market dominion, the choice of priorities and the compulsion of the highest order becomes vitally important. yu at the scale of the region.

Risks are classified according to subjects, types and manifestations. A subject of risk is a legal or physical person who is in a situation of risk and is aware of it. Zazvichay there are three subjects of receiving risks:

- enterprises-virbologists;

- individuals (besides individuals who have income);

- other entities (organizations in non-viral spheres of activity, including government agencies).

A type of admission risk is a grouped situation that is close to the awareness of the risk and behavior in risk situations. Current economic literature shows a variety of different types of rhizics. In some classifications there are up to ten to thirteen different types of admission risks. With all the diversity of approaches to the classification of risks, you can see a number of main types:

- virobnichi (clean);

- investment and innovation;

- financial;

- goods;

- comprehensive;

- banking

The remaining type of risks is seen in a regional position through the importance and specificity of its various manifestations, and then tracked in the number of financial risks.

Under the manifestation of an accepting attitude, it is understood that the surrounding subject is united with the associated type of attitude. Having shown rizik and more private concepts of the type of rizik, fragments of that very type of rizik can be a few manifestations that concretize it. In addition, by this very type of risk for different subjects there are different manifestations of acceptance risks.

Apparently, the main risks for the species are for the most important subjects – virus producers.

Among the virus risks, the main manifestations are the risks of slow growth and irregularity in the work of enterprise, as well as natural disasters, disasters and accidents (wars, earthquakes, fires, etc.). Virological risks are generally divided into risks in the sphere of industrial production and other spheres (most importantly in the sphere of agricultural production).

Investment risks for manufacturing enterprises are identified most importantly at the stages of project preparation and implementation.

The main manifestation of the financial risks of manufacturing enterprises is the threat of bankruptcy. To what type of risks are financial risks related to non-removal of income and risks from operations with valuable papers.

Commodity baskets for winemaking enterprises are the main source of risk for shortages of goods and lack of supply.

The main manifestation of complex risks is the risk of inflation.

The main manifestations of banking risks are the risks of credit, interest, liquidity of the bank, deposit operations and breakdowns, as well as bank fraud.

Obviously, such a classification of risks by their different types and manifestations is intellectual, since it is impossible, for example, to establish a clear difference between investment and financial risks.

The main manifestations of risks in physical persons:

- with virobnic riziks - waste of usefulness;

- in case of financial risks – non-violent duties and transactions with valuable papers;

- with commodity vests - unemployment.

The main manifestations of risks for others legal entitiesє financial currency risk, commodity risk will drink huge services, a complex risk of the reaction of firms and employees to the level of entry in the sphere, etc.

Thus, the administrative and lordly activity is a concept that will overlap. Not every government activity can be taken into account.

In connection with this, there is a special interest in categories "profit"і "Adoptive income". The legal form and distribution of income (income) will be discussed below.

Entrepreneurship is a risky activity. The category of “admission prisoner” has not yet become a subject of increased respect for learned lawyers due to its “youth”. Inextricably linked to the category of enterprise risk is the concept of enterprise income and surplus. To ensure the possibility of income, the entrepreneur is responsible for taking the wine and covering possible surpluses, then. The enterprise may be conducted for the purpose of the enterprise, at its risk." Prote subjective side entrepreneurial activity- a special subject of investigation.

N.S. Malein identified the risk through the genuine uncertainty of the present and the incessantity of negative main influences, the legitimate creation of insecurity in the minds of the people for good purposes and the availability of alternatives, meaning that "... there, obviously the inevitability of the onset of negative inheritances, there is no risk there.” It needs to be said that the rizik is a real concern.

V.A. Eugensicht defined the risk as “the mental conditioning of subjects to the results of official actions or the behavior of other individuals, as well as to the possible result of an objective outcome and sometimes impossible actions, which is reflected in a clear assumption negative, including unknown, new inheritances “And as “determinations”, which does not include the achievement of an undesirable result, it occurs with the knowledge that an erroneous result is allowed and the possibility of negative consequences associated with it.” It is not important to note that such an interpretation Rizika brings this concept closer to the psychological concepts of guilt and practicality between them is a sign of jealousy.

From a theoretical point of view, the problem of risks is always investigated by academic economists. G.V. Chernova, A.A. Kudryavtsev understands under the hood, looks up:

a) the potency (safety) of the current world of action or the totality of the action that evokes song material beats;

b) the possibility of undeterred profit and income. Apparently, the initial sign of rhizik is the potentiality of the emergence of a possibility.

Rizik - “the possibility of unpleasant situations arising during the implementation of plans and the adjustment of enterprise budgets.”

See rizika: industrial, commercial, financial (credit), investment and market.

Virobnichy rizik associated with the production and sale of products (work, services), any type of manufacturing activity.

Commercial vest It depends on the process of implementing the purchase of good goods by the enterprise and the process of providing services.

Financial rizik You may get stuck under the hour of financial (penny) interests. The reason for the investment risk may be the value of the investment and financial portfolio, which is formed from the power and additions of valuable papers.

Rinkoviy rizik due to possible changes in market interest rates, the national penny unit or foreign exchange rates, and possibly both at the same time.

The main power of the rhyme is an indication of the possibility of the present and the impermanent nature of any kind of world (group of reasons). We also emerge from the designated power of the rizik and see it as a daily one in the characterization of the host rizik.

It must be said that the category of riziku is very rich. In connection with this, one cannot help but remember about the rule of the ruler (Article 221 of the Central Committee of Ukraine), the buyer (Article 459 of the Central Committee of Ukraine), the lessor (Article 669 of the Central Committee of Ukraine), parties to contracts in a row (Article 705 of the Central Committee of Ukraine) , insurance (Articles 944, 945 of the RF DC), enterprise (Articles 929, 933 of the RF DC) and other matters. The skin of these types of diseases has individual signs and symptoms. So, at st. 933 of the House of Culture of the Russian Federation, the possibility of stipulating the insurance contract for the undertaking of the enterprise has been transferred, under any provisions of this article. 929 of the Civil Code of the Russian Federation, there is a risk of disruption in the business activity through the destruction of obligations by counterparties to the business or a change of mind in the business outside of the business furnishings, including the risk of non-recovery of generated income.

In legal literature, the meaning of the administrative principle, without any unambiguous interpretation, is seen as “activity in a situation of uncertainty for the clear removal of profits and the accumulation of profit, in the minds of the impossible information about accurate transfer of activity results." and as “the potential danger of wasting resources or under-recovery of income from the forecast of the enterprise itself.”, and as “possible unpleasant consequences of the enterprise’s activity, which are not intended to be overlooked "Lady on your side." In a word, a whole palette of views is on guard.

Administrative activity is heterogeneous and can be classified from different subdivisions: type of activity, forms of power, number of leaders (principals), etc.

It is true that the sphere of its stagnation is divided into entrepreneurial activities that occur in industry, capital everyday life, rural dominion, science, etc.

Entrepreneurial activities can take place in both the industrial and non-viral sectors. From the perspective of the production cycle, one can speak, for example, about production activities at the stages of design, production (manufacturing), transportation, saving, sales of products (work, services), installation and operation, technology proper maintenance, disposal and disposal.

The designated gradation of entrepreneurial activity evokes a practical sense. So it was in the tax legislation that the amount of taxes is determined according to the type of business activity (manufacturing, trading, middleman, etc.).

Entrepreneurial activity is not limited solely by the boundaries of the industrial sphere. It also occurs in the social and cultural sphere (for example, in education, culture, health). For example, initial pledges (including sovereign installations) may contribute to entrepreneurial activity.

Based on the protection of a number of rulers (principals), administrative activities can be divided into individual and collective. The first one is a citizen (individual), the other is a legal person (commercial and non-profit organizations). Sometimes the literature uses the terms “corporate organizations”, “enterprise awareness”, etc.

Vikorist such a criterion, as a form of power, is divided into powers, municipalities and private entities.

Other options are possible for the classification of business activities (for example, by subjects, organizational and legal forms of legal entities, etc.). For example, from the subjective perspective one can see the subjects of small, medium and large businesses.

The drive of the receiving activity is driven by various connections. Receiving (horizontal) drains Maynovi vydnosini of a commodity-penny nature, which has cooperative activities between subjects of government and between the rest and the population. In the sphere of the names of the containers one can find satisfaction with the industry and other needs of the subjects of government.

In its own way, receiving (vertical) lines are formed between administrative bodies and subjects of government in the process of carrying out their receiving activities. Their place is to establish organizational activities of various management bodies (antimonopoly, financial, tax authorities, standardization bodies, metrology, etc.).

A special group of bills, regulated by strict legislation, is approved by internal company (internal government) bills. The stench is an independent sphere legal regulation. These notes are regulated by enterprises (organizations) of local legal acts.

Internal company management plans are formed between the enterprise and its structural subdivisions. In this case, for example, internal company planning and forecasting take place. The main function of management is to select and make decisions. Its other functions include control, design and analysis, which are transferred to the decision-making functions.

Fold another group of containers, which are knitted with legal status founders (participants) of enterprises. Subsequent local (corporate) legal acts regulate their rights and obligations, responsibilities for the obligations of the enterprise.

An independent place in the system of internal company transactions is occupied by the organization of legal work for business. The organization (organization) is also regulated by acts of local action.

The standard for reasonable business is the norm of Art. 34 of the Constitution of the Russian Federation, which states: “Everyone has the right to freely exploit their interests and have space for entrepreneurial and other economic activity not protected by law.”

Otherwise, according to the Basic Law, entrepreneurial activity is economical activity. This situation is ignored by both economists and lawyers. There is no entry for entrepreneurial activity as a type of economical activity and for legally designated entrepreneurial activity, which is located at Art. 2nd Central Committee of Ukraine. A further analysis of official legislation shows that laws and other normative legal acts that make a specific activity acceptable or inappropriate, themselves require legal assessments of their actions Subjects of the Constitution. Let's point it like a butt of two laws.

Delivery to station. 1 Fundamentals of the legislation of the Russian Federation on notaries since February 11, 1993. (as amended by the Federal Law dated June 29, 2004 N 58-FZ) notarial activity does not constitute an acquisition and does not entail the withdrawal of profits. These provisions apply both to state notary offices and to notaries engaged in private practice. So, the money collected by a privately practicing notary, after paying taxes and other obligatory payments, rests with his authority and order. And these cats really hurt.

On the other hand, the Law of the Russian Federation dated 10 June 1992 N 3266-1 “On lighting” (as amended by the Federal Law dated 20 Law 2004 N 68-FZ), in which, by virtue of Art. 48 Individual labor and pedagogical activity with the deduction of income is recognized as entrepreneurial and promotes state registration. Such activities are not licensed. This is the name given to tutors, who systematically help children master school disciplines better, and who have a lot of legal rights to accumulate.

The concepts of “industrial activity” and “trade activity”, in our opinion, are not synonymous. It appears that the process of producing a product (product) can be broadly divided into stages and types of activity. Tse - marketing (poshuk ta vivchennya rynku); design and (or) development of technical products; preparation and development of production processes; virobnitstvo (meaningful to the university); trade (trade-intermediary, trade-purchase) activity; control, testing and quilting; packaging and saving; installation and operation; technical maintenance; recycling of vikoristan. These stages and types of activity are described by the term “life cycle of production”, which has been legally enshrined in Russian technical legislation and is widely stagnant in practice. Foreign legislation uses the concept of a “brace loop”, introduced by ISO 9000 series standards. From this vantage point, the main stages can be seen life cycle products: production, distribution, exchange, production (exploitation).

Virobnitstvo- this is the stage within which the product is created, or more precisely, material goods and services. Divided and exchanged to mediate connections between production and production. Dodamo – and not only that. In the singing sense, effective reproduction is impossible without the “primacy” of exchange and division.

According to A. Marshall's final words, this can be seen as a kind of negative generation, since it is likely that there will be a change and destruction of the primary authorities in the product. There are two types of cohabitation: individual and virobnic, or more productive, cohabitation.

Exchange plays in the process of production. In economic literature there was a great deal of attention to the productivity of exchange. Like production, exchange is also productive because it involves the transfer of goods from the vastness in such a way that human needs are better satisfied and, therefore, the wealth of the household increases. The productive nature of the exchange is consistent with the stereotype of the idea that is expressed in the general information about those that traders “do not create anything.”

Also, trading and trading (trading-intermediation, trading-purchasing) activity is an independent type of “life cycle of production”. In its economical sense, trade enters the stage of exchange of food products.

Prof. G.F. Shershenevich wrote: “The activity that involves mediation between producers and co-workers in the exchange of economic benefits is called trade.” In its own right, trade is divided into wholesale and disaggregated.

Trade is a type of activity that involves the sale of goods for sale.

ROZDIL 2. Organizational and legal forms of business activities in the tourism sector

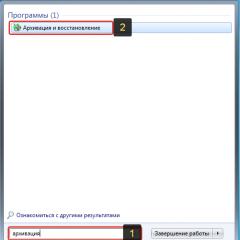

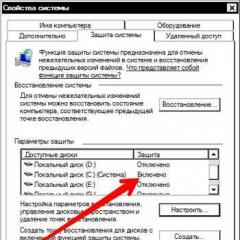

Meta lectures: Consider nature, the type of host risk, the reasons for its modification and methods of minimization

Lecture outline:

3.1 Understanding the functions of riziku

3.2 Classification of receiving risks

3.3 Costs of risk and their causes in entrepreneurial activity

3.4 Ways to change risk insurance for business activities

Understanding the functions of riziku

With a risik and different galuzes, people have always been involved in activities. The fundamental nature of the work reveals the essence and replacement of the economic categories “sovereign vestment”, “priest vestment”, which is no longer available.

In the most recent view in the “Russian Dictionary” by V. Dahl, the rizik appears on one side, as if it were not safe; On the other hand, it is an infusion of success, which emphasizes courage, courage, and perseverance in the hope of a happy result.

In “The Daily Economic Dictionary” by B. A. Raizberg and others. it is stated that rizik is a liability for non-transferable expenses of the generated profit, income and main, pennies worth in connection with the episodic change of minds of economic activity, unpleasant situations.

In today's economic dictionaries, the rhizik has a lot of respect. Thus, in the “Tlumachny economic and financial dictionary” I. Bernard and J.C. Collie give the following important rhyme: “An element of insignificance that can be seen in the activity of one or another subject of government or in the behavior of any economical operation.”

Whose dictionary has information about those whose business activity is to take revenge on the risk that an entrepreneur can take. Vіn signifies the nature and scale of the risk.

Entrepreneurial activity- This is innovative risk activity. Sustaining new technologies, new equipment, new methods of organizing business, production, innovative marketing, management, etc., an entrepreneur, obviously runs the risk of accumulating crowds, wasting some or all of the resources. Ale vin does not pay for expenses, but rather for the purpose of withdrawing personal income. And, as practice shows, it is taken away from the rich in bad situations.

Why are firms of the innovative, entrepreneurial type likely to have higher profitability and a higher level of competitiveness equal to those that occur in the process of development from the replacement of traditional technologies? and technologies, methods of organization and management of production.

Thus, a sample survey of 50 financial firms in the United States showed that the averaged indicator of profitability of “residential capital” is 3 times higher than for the initial capital invested shares. 70% of these companies have low profitability of over 20%, others – over 30%.

In economic literature, the terms “sovereign vestment” and “sovereign vestment” are coined. Moreover, most often these concepts are understood as identical. In truth, these understandings are very close, especially when it comes to understanding the ruler’s principle of entrepreneurial activity. At the same time, they cannot be considered identical.

The Lord's vest, more broadly understood, is the lower receiving vest, although the remaining one is the main warehouse of the Lord's vest.

Rizik- This may not be safe.

In economic theory, the risk is considered to be the likelihood (threat) of losing part of the income from the ongoing economic and financial activities.

Thus, under the entrepreneurial risk, it is understood that there is a potential, enormous waste of resources that results from any type of activity associated with the production of products, goods, services, Their sales, commodity-penny and financial transactions, commerce.

In these types of activities, the mother has to deal with a large amount of material, labor, financial, information (intellectual) resources, and there is a risk of being associated with the threat of wasting these resources, either completely or occasionally.

With the meaning of the concept “rizik”, such popular words as “waste”, “beats”, “beats” are used.

When these words are used before economics, you need to know what is meant by them. We spend what we have little and what we have spent. In economics, there are the words “waste”, “waste”, “waste”, which also mean what happened and what happened.

For example, a beautiful suit is sewn and the fabric is worn on it. There is no wastage, the stink is transferred far away. If the same Kravets accidentally cut the fabric and cut the suit incorrectly, it turns out that the three meters of fabric needed to sew the suit became 3.5 meters. So the axis, 3 meters is tse vitrata, and 0.5 meters is tse vtrati.

Another example, the entrepreneur decided to create other books and sell them at a price of 500 tenge apiece. However, hostile minds formed on the sales market, they decided to buy the book and found themselves worthless and had to sell them at a price of 400 tenge per piece. As a result, the entrepreneur spends 100 tenge in income on the skin book.

The enterprise risk is characterized as the risk of untransferred, uninsurable wastage of resources and under-recovery of income against the option of insured rational use of resources. Otherwise, it seems, the risk is the threat of the fact that the enterprise recognizes the costs of additional expenses for the transfer of the forecast, project, plan, program of its actions, or it deducts income lower than those for which it has been insured.

Now, at the hour of establishment of the administrative authority, it is necessary to separate the concepts of “withdrawal” and “surcharge”, “spend”. Any business activity is inevitably associated with expenses, since problems arise in the event of an unpleasant situation, breakdowns, and additional expenses are set as intended. Before mixing the traces, it is necessary to introduce and waste, so as not to bring the effect to the full result.

A further look at the essence of the administrative risk is related to the associated functions, which is the outcome of the administrative activity.

In the economic literature the following functions of rizik are seen:

· Innovation;

· Regulatory;

· zahisna;

· Analytical.

The innovative function of the reception center is stimulating the search for non-traditional solutions to problems facing the receptionist. Most foreign firms and companies achieve success and become competitive on the basis of innovative economic activity associated with the risk. The risky decisions, the risky type of government, lead to more effective generation, in which both the adopters, the companions, and the spouses win.

The regulatory function is of a super-sensitive nature and appears in two forms: constructive and destructive. The risk of adoption, therefore, is the direct deprivation of significant results by non-traditional methods. Tim himself allows for conservatism, dogmatism, backwardness, and psychological barriers that interfere with promising innovations. In this case, the constructive form of the regulatory function of the receiving rizik is manifested.

The constructive form of the regulatory function of risk is that the creation of risk is one of the ways of successful business activity.

If the function of risk is limited to those who are naturally born to accept risk, then it is normal to tolerate failures. Initiative, committed government officials need social protection, legal, political and economic guarantees that prevent punishment in case of failure and stimulate the acquittal of punishment.

In order to apply for a risk, the acceptor must insist that a possible pardon cannot compromise either his rights or his image.

The analytical function of the receiving rizik is connected with the fact that the detection of rizik conveys the need to select one of the possible solution options, which is related to the acceptance process. It analyzes all possible alternatives that are the most cost-effective and least risky.

Considering the functions of the receiving resource, it is worth mentioning once again that, regardless of the significant potential for spending, what the risk carries, but also the potential for profit. Therefore, the main task of admission is not based on the risk of admission, but the choice of decisions related to the risk on the basis of objective criteria, itself: to what activities can be accepted while going to the prison.

In addition, the host's vest also has a social function. In keeping with the increased efficiency and stability of creation, this creates a real material basis for satisfying social needs and promoting the well-being of the population. With the increase in the number of enterprises, firms and their companies, the employment of the population is stabilizing.

The Lord's risk is to develop entrepreneurial spirit among the entrepreneurs themselves, as well as among managers, clerks, and all workers.

Risk is a key element in the brainstorming of market economics. Characteristic rice rizik – insignificance, lack of confidence, lack of confidence, let-go, that success will come. In the minds of political and economic instability, the pressure on Riziku is growing significantly. In today's crisis minds, the problem of strengthening risks is even more pressing.

Risk is the possibility of eliminating unpleasant situations during the implementation of plans and the adjustment of enterprise budgets.

In entrepreneurial activity, it is important to correctly distribute the risks between counterparties. The most important risk is that of a partner to the project, which is better than others that can insure and control the risks. The risk is divided during the development of the financial plan for the project and contractual documents.

The following are the main types of risks:

The viral risk is associated with the production and sale of products (work, services), and all types of viral activity. This type of risk is the most sensitive to changes in the obligations of production and sale of products, planned material and labor costs, to changes in prices, etc.

In today's minds, Russia has a great virobnic rizik, so the virobnic activity has become the most rizik.

This sphere has rhizics:

Unknown agreements of the rulers,

Change market conditions, increase competition,

Viniknennya of non-peredubachenih vitrat,

Spend your business time.

The commercial risk arises from the sale of goods purchased by the enterprise (services provided). It is necessary to pay attention to such officials from a commercial enterprise as: unforeseen change (advancement) in the price of production facilities that are purchased; reduction in the price at which products are sold; loss of goods from the process of production; subdivision and expenditure.

The financial risk may collapse due to the development of financial enterprises and financial (penny) interests. The financial risk is affected by a number of factors characteristic of other types of enterprise risk, such as the insolvency of one of the parties to the financial sector, the exchange of currency and penny transactions, etc.

The reason for the investment risk may be the value of the investment and financial portfolio, which is formed from the power and additions of valuable papers.

The market risk is due to possible fluctuations in market interest rates, national penny unit(s) or foreign exchange rates.

The consequences of political risks may include a decrease in business activity of people, the failure of adopted legislation, instability of tax rates, disruption of payments and mutual frosts, foreign exchange of funds.

Expenditures for the risk of business activities are divided into:

Material expenditures - not those transferred to the project, but direct expenditures of material objects in natural terms (materials, spores, transmission devices, products, materials, raw materials, etc.).

Labor wastage - wastage of a working day caused by sudden or unforeseen circumstances.

Financial expenses result from direct penny loss (non-transferred payments, fines, payments for overdue loans, additional payments, loss of funds and valuable documents).

It takes a while to figure out when the process of receiving activities progresses more, less transferred by the project.

Special types of expenses are expenses associated with the ill health and life of people, the excessive middle class, prestige of the enterprise, and other unpleasant social and moral-psychological factors.

The methods of allowing the acceptance risks include uniqueness, attenuation, transfer, lower level.

Under the unique risk, it is understood that there is simply a pretense at the end, with a risk. However, a unique risk for an enterprise often means a loss of profit.

The reduced risk transfers the excess risk to the investor, then. from his responsibility.

Transfer of a risk means that the investor transfers responsibility for the financial risk to someone else, for example, an insurance company.

A lower level of rizik means a shorter transfer of money and less expenditure.

When choosing a specific method for increasing the financial risk, the investor must proceed from the following principles:

1) it is not possible to reduce the capital any more;

2) you need to think about the inheritance of the rizik;

3) you can’t rizikuwati for the sake of little.

The implementation of the first principle means that, before investing capital, the investor can:

Significantly, the most powerful person drank the zbitku after the zim rizik;

Equalize the capital that is invested;

Provide him with all the available financial resources so that the loss of his capital will not lead to the bankruptcy of the investor.

The implementation of another principle requires that the investor, knowing the maximum possible amount of cash flow, determine how much it can be achieved, what is the fairness of the risk, and having made a decision about the cash flow of the risk (that is, the entry), about taking the risk into his own account. Subject to the transfer of risk for the conformity of another individual.

The effect of the third principle is especially clearly manifested during the transfer of financial resources to the government. Which type of wine means that the investor is responsible for determining a more favorable relationship between the insurance premium and the insurance amount. Risik ni buti utrimaniy, so. The investor is not required to take on the risk, since the size of the cash reserve is remarkably large, in line with the savings on insurance deposits.

To lower the level of financial risk, there are different ways:

Diversification means diversifying the investment risk, then. division of funds that are invested between different investment objects that are not directly related to each other.

Limit - setting a limit, then. limit sums of payments, sales, credit etc. Limitation is an important way of reducing the level of the risk and is established by banks when they receive a position at the time of setting up an overdraft agreement; by the governing entity - under the hour the sale of goods on credit, for traveler's checks and euro checks, etc.; as an investor - as much as the amount of capital invested.

Insurance, the essence of which is that the investor is ready to take part in the income, or lose the risk, then. he is ready to pay the reduced level of the rizik to zero. During the insurance process, there is a redistribution of costs between the participants of the insurance policy insurance fund: the distribution of premiums to one or several insurers results in the distribution of expenses for everyone. The number of insurers who have made payments during the same period is greater than the number of insurers who have made payments during the same period.

Securitization is the fate of two banks in a credit operation. Credit agreement consists of two stages: 1) the development of minds and the establishment of a loan agreement (agreement); 2) giving a loan to the owner. The essence of securitization lies in the fact that the two stages involve different banks.

Rizik- This is the certainty of the guilt of expenses and a decrease in generated income and profits against the permissible option due to a sudden change in the minds of economic activity, unpleasant, due to force majeure, circumstances.

Pid host's robes It is accepted to understand the possible (imminent) insecurity (threat) of the failure to transfer material and financial expenses by the project plan by accepting part of the income from the inheritance of the enterprise (industrial, commercial) There is a lack of importance and lack of information in the minds of foreign, investment and financial activities for making management decisions. The main reason for the change in the entrepreneurial risk is competition and the rise of alternative options that feed the development of the enterprise and the efficiency of its functioning.

The reasons for the admission risk are:

Untransferred changes that have come in the middle of nowhere (price increases, changes in tax legislation and the socio-political situation, etc.);

Appear more prominent propositions for partners (the ability to enter into a larger contract with more additional terms and payment options), which allows them to be confident in the arrangement or termination of additional benefits;

Changes in partners’ goals (due to advancement in status, accumulation of positive results of activity, change of strategy, etc.);

Change of minds, movement of commodity, financial and labor resources between enterprises (emergence of new minds, new cordons, etc.).

Separate global(foreign powers) that local(On the level of enterprise) risiki. The stinks become one another, merge one on another, and at the same time are autonomous. For example, when decisions are made by equal powers to change (strengthen) the tax, credit and financial policy, introduce elements of risk into the activity of the enterprise. And as a result, in addition to the decision adopted at the level of enterprises to change the range and scope of production, the introduction of other social programs may also come into play due to the interests of foreign powers and disputes. the emergence of global risks.

For triviality, the following will be divided:

Short-term risks - risks in which the threat of expenses is limited by a short period of time (the choice of a non-obligatory counterparty, a transport risk in case of transfer of the final obligation; a risk of non-payment for a specific purpose);

Permanent risks - risks that constantly threaten entrepreneurial activity in a given geographical area or in the current state of the economy (risk of non-payment in a country with an incomplete legal system; risk of protection and protection quotas for production of products).

The vineyards are classified as follows:

Vlasne Gospodar's Rizik;

Rizik, related to the specialness of the workers;

Rizik, zoom in on natural factors.

The reasons for the blame include the following:

awareness of the insignificance of the future;

Non-transfer of partners’ behavior;

Not much information.

Based on the types of enterprises, risks are classified into industrial, commercial and financial.

Virobnichy rizik- as a result of the production of non-competitive products (work, services), from the current ineffective production activities, the lack of similarity of products, food production, growth yam material and other expenditures, increased expenditure of working hours, payment of advance taxes and payments for credit, which lead to a decrease in fortune-telling obligations and its effectiveness. Viral risk includes a number of risks, such as technical and investment.

Technical vest - risk of losses caused by ineffective technologies and materials, equipment breakdowns.

Investment rizik - There is a risk of recognizing surpluses or not losing profits as a result of capital investment in new equipment and technologies, the production of products based on unmatched resources.

Commercial vest - There is a risk in the sphere of sales of manufactured goods and services, or when purchasing necessary resources by an enterprise. Reasons for commercial risk: decreased sales obligations due to changes in market conditions, increased purchasing prices of resources, untransferred decreased purchasing obligations, costs of goods production processes, increased costs Nennya. For example, commercial vests show:

Risks of incorrect choice of economic goals for an enterprise project (unidentified priorities of global economic and market strategy of enterprise; inadequate assessment of the needs of moisture generation and current living room);

Risks of lack of funding for the project or the availability of funding for the project under the hour of its implementation;

Risks of failure to maintain the planned video schedule or income schedule for the project;

Marketing risks for products or procurement of resources for an enterprise project;

Risks of interaction with counterparties and partners;

Risks of non-transfer of costs and transfer of costs for the project (risk of increased market prices for resources; risk of increased interest rates in the future; risk of the need to pay penalties and arbitration and court costs);

Risks of untransferred competition (risk of entry into the market of businesses from other countries; risk of the emergence of local young businesses-competitors; risk of expansion into the local market from the side of foreign exporters).

Financial rizik – There is a risk in the sphere of transactions with banks and other financial institutions. The financial risk of an enterprise is most often determined by setting the value of the position capital to the value of the financial capital. The greater the value, the greater the amount of business that creditors have in their activities, the greater the risk, since the increased lending and the strengthening of minds to credit can lead to a suppression of growth.

It is possible to establish an additional classification of receiving risks.

It depends on what level the stinks arise and what scale of their action, the risks are separated:

mega-economic, associated with the functioning of the light economy;

macroeconomic, related to the function of the baths economic system these powers;

mesoeconomic, are formed exclusively on the level of other areas of the economy and specific areas of business;

microeconomic, are formed only on the level of other government-ruling subjects.

In totality, all these risks are created A single economical rhizic flow, What is there in steady Russia, from now on there are so-called “stick layers” between the levels and besides the risks of “living” on different levels at the same time.

There are many reasons why the risky situation is to blame, and the risks are divided external and internal . Jerelom Viniknenya external risks It is the same as the middle one before receiving it. Whom Dovkill officials can give both directly and indirectly, then. indirect impact on the vitality of the organization. Managers of an organization cannot capitalize on these risks, but rather transfer and absorb them into their activities. For example, there may be changes in legislation, changes in the tastes of people, intensified competition, the stability and fragility of the political regime of the country, strikes, nationalization, wars, etc. Internal vestments arise from the influx of factors from the internal middle of the subject of government, for example, ineffective management, lenient marketing policies, and the legacy of internal corporate malfeasance. Such risks can be completely changed in order to effectively organize the production sovereign activity and management.

Trace can also be seen acceptable, critical and catastrophic risks . Acceptable rizik- this is the threat of expenses of a smaller size or at the same level as the realized profit from the implementation of any other project or business operation. Critical Rizik associated with unsafe expenses in the form of increased expenses for the project and business operations. In this case, the critical risk of the first stage is associated with the threat of losing zero income, and also for the loss of material losses. The critical risk of another level is associated with the possibility of expenses in the form of new expenses as a result of the implementation of a project or business operation. Pid catastrophic risk This is understood to be a risk that is characterized by unsafe expenditure in a size that is ancient or outweighs the intensity of every major stage of the organization. A catastrophic risk may lead to bankruptcy.

Behind the level of legitimacy of the ruler's riziku can be seen justification (legal) і unjustified (illegal) riziki. There is a border between them in different types of government-government activity and in different sectors of the economy.

All sovereign risks can be divided into two large groups, depending on the possibility of insurance: insured and uninsured . Insurance risk- It’s clear that insurance coverage will be lost whenever something happens. Of course, insurance risks are divided into risks associated with the manifestation of elemental forces of nature, and risks associated with the direct actions of people. If the expenses that result from an insured risk are covered by additional payments from insurance companies, then the expenses that result from an uninsured risk are reimbursed from the power costs of the organization.

In addition, the vests are divided purely and speculatively . Particularity pure risks It is believed that it is practically possible to recognize the expenses from time to time. In this case, expenses for the organization, as a rule, mean one-hour expenses for marriage. For change in the name of pure risks, speculative risks carry either expenses or profits for the organization.

Pure risks due to the causes of culpability are divided into natural, environmental, political and commercial. . Before natural-natural rhizikam There are risks associated with the costs of the negative influx on the assets of the organization of natural disasters. Ecological vests- ceremonies associated with problems dovkilla. Political vests connected with the political situation in the region and the activities of the state. The appearance of this type of risk is especially important in the countries due to the tireless legislation, tradition and culture of adoption. To assess the political risk, a comprehensive set of specialized analytical centers, both commercial and non-commercial, has been created to assess the stages of political risk in these countries for different countries.

Political risks are divided into the risks of nationalization, transfer, contract termination, military actions and civil thefts.

Risks of nationalization be interpreted even more broadly - as expropriation without adequate compensation to the ownership of the organization or, for example, restricting investors' access to asset management.

Riziki transferu related to the transfer of local currency into foreign currency. There is a stench of the impossibility of promoting full-fledged government activity as a consequence of the reduction of conversion national currency payment in currency.

Riziki will revive the contract associated with situations where the contract is terminated for reasons independent of the partner through the actions of the authorities of the region where the counterparty organization is located, for example, due to changes in national legislation and the introduction of a moratorium on foreign and payments.

Risks of military operationsі civilian thieves connected with the impossibility of carrying out government activities following these steps, which can lead to great expenses and lead to bankruptcy.

Commercial risks are the risk of expenses in the process of industrial-government activity, they are divided into mines, industries, and trade.

Main's Risiki associated with the likelihood of wasting the organization's resources as a result of: malicious actions (through theft, sabotage, dishonesty); death or unemployment of key workers and the main leader of the organization (due to difficulties in selecting personnel with the same qualifications and problems of transfer of power); threats to the power of third parties (due to the need for forced activity).

Virobnichi vests associated with any type of industrial activity, if the following situations arise:

The shortening of production commitments due to decreased productivity, downtime, waste of working hours, the lack of necessary quantity of raw materials, materials, components, burning, energy, supply of raw materials ;

Reduced prices for products that are expected to be due to their lack of supply, an unfavorable change in market conditions, and a drop in price;

an increase in material waste as a result of the excess waste of raw materials, materials, components, firewood, energy, as well as for the increase in transport costs, trade costs, overhead and other costs;

Increase in payment to the fund for the increase in the number of workers or in connection with the payment high level wages, as planned;

An increase in deductible and non-deductible payments as a result of changes in their rates from a party unfavorable to the organization;

Low supply discipline, interruptions in the supply of energy resources;

The physical and moral wear and tear of possession.

A reinforced group is seen at the warehouse technical risks, which are associated with the unsafe expenses that result from man-made disasters and equipment breakdowns. Technical risks lie in the level of production organization, timely implementation of preventive visits (regular installation prevention, safety visits). In this case, the risks of costs that arise from problems with robotic computer systems when processing information are called operating vests.

At the warehouse, there are also innovative risks, what is wrong with this:

Negative results of scientific research and research and design developments;

Incorrect evaluation will result in new products if the buyer does not know the new product or service;

Incorrect assessment of the effectiveness of expenditures on new, cheaper technologies, since for such a short period of time the organization is the only user of the new technology and the additional costs do not rise to cover the increase in expenditures;

The inconsistency of new products and services with the norms and regulations and the impossibility of selling the resulting new equipment, since it is not suitable for the development of other products or services;

The incompatibility of the new product with the technical parameters planned during the design and technological developments, through the replacement of the old installation.

Trade vests depend on the process of selling goods and services, transporting and capturing them by the buyer:

Reduction in sales obligations due to the decline in demand, pressure from competing goods, and reduction in sales;

payment delays;

Spend on the product;

waste of goods in the process of transportation (transportation, storage), which leads to a reduction in price;

The increase in expenditures is equalized from the planned payment of fines that were not transferred to the fund, which will lead to a decrease in the organization’s profits.

Risks associated with transported goods, transport vests, were most often the cause of conflicts between subjects of government.

Speculative risks arise from the process of interaction between an organization and financial institutions, also called financial risks Financial risks are divided into two large groups: risks associated with the purchasing power of money, and investment risks associated with capital investments.

Before the risks associated with the purchasing power of pennies, There are inflationary and deflationary risks, liquidity risks, and currency risks.

Inflationary risk – The risk is that with increasing inflation, penny incomes will depreciate in terms of real purchasing power sooner rather than later than the nominal value. In such minds, the organization recognizes real costs. Deflationary rizik – The risk is that with increasing deflation there will be a fall in the price level and a decrease in the organization’s income.

Risks of liquidity – risks associated with the possibility of expenses when selling goods through a change in the assessment of their cost and survivability.

Currency accounts represent the risk of expenses as a result of changes in exchange rates that may occur during the period between the establishment of the agreement and the actual development of the regulations behind it during the implementation of foreign economic, credit and other matters. currency transactions. The currency risks for the importer and exporter are separated. Currency reserves for the exporter associated with the falling exchange rate of foreign currencies from the moment of cancellation or confirmation of the agreement until the cancellation of payment and the hour of negotiations. Currency reserves for the importer due to changes in the exchange rate between the date of confirmation of the agreement and the day of payment.

Currency accounts include three types: economic account, transfer account, and favor account.

Economic rizik The organization is aware that the value of its assets and liabilities may change to a greater or lesser extent due to future changes in the exchange rate.

Rizik will translate It is of an accounting nature and relates to the changes in the assets and liabilities of an organization in foreign currency.

Rizik please - the reliability of ready currency exchange rates for business transactions in Foreign currency. The risk, in this way, considers the influx of changes in the exchange rate, the future flow of payments and the future profitability of the organization.

Investment risks support the organization with the investments made in these and other projects and include the following types: capital, selective, regional, time-hour, the risk of wasted profits, the risk of reduced profitability, the risk of direct financial expenses. According to expert assessments, the investment risk in Russian organizations using a 10-point system today averages 7-10 points, in US organizations – 1-4 points.

Capital rizik – The risk is that the investor will not be able to get out of the investment without expenses.

Selective rhizik – the risk of choosing the wrong object for investment in comparison with other options, which are small in place.

Regional riziq – the risk of expenses associated with investments in objects that are under the jurisdiction of a region with an unstable socio-economic status.

Timchasy rizik - the risk of expenses associated with investing funds at an unusual hour.

Risk of wasted benefits This is due to the rise of indirect financial gains in the appearance of an undeniable income from the future, no matter how you go.

Risks of decreased profitability include capital and credit risks.

Before to the hundred-year-old riziks There is concern about the organization's expenses due to the increase in the monthly rates that are paid on the funds received, above the rates on the loans issued. In addition to interest risks, there are also cost risks that investors may recognize in connection with changes in stock dividends, interest rates on the bond market, certificates and other securities. An increase in the market rate will lead to a decrease in the exchange rate of securities, especially fixed-rate bonds. When the price is moved up, a massive discounting of valuable papers may begin, issued under lower fixed prices and at the disposal of the issuer, which will be taken back before the date. The capital risk is borne by the investor, who invested the cost in the mid-market and long-term price papers with a fixed price for the flow rate of the mid-market price is equal to the fixed price. An investor can get an increase in income for the same amount of money, but cannot save his money on investments previously made. The multi-hundredth edition bears and emitter that issues both mid- and long-term high-value papers with a fixed price, for a continuous reduction in the mid-market price with a fixed price. The issuer could obtain cash from the market at a lower price, or even be associated with the release of valuable papers.

Credit risks Due to the possibility of unconventional organization of their financial obligations, they are obliged to the investor under the hour of subordination to the financial activity of the government-government activity of the current position. Also, credit risks are the risk of non-payment by the principal of the main bank and the sums due to the creditor.

Credit risks also include the risks of such funds for which the issuer, who issued the securities of the bank, cannot pay the sum for them or the main amount of the bank.

Credit risks are divided into main ones, morality and business. Mainovy rizik This means that the owner's assets may not be sufficient to cover the loan obligation. Moral Rizik connects with the moral rigors of the boss, the carelessness of his doubts. Dilovy risik This indicates the extent to which the organization is able to generate the necessary income during the period for which it took out a loan, and is associated with the insecurity of the deterioration of the competitive position of the organization, which has taken away the commercial activity of banks such a loan, due to the unfavorable economic situation.

Risks of direct financial expenses include stock market, selective and bankruptcy risks.

Birzhovi risikiє unsafe spending on stock exchange lands. There are also risks involved, for example, the risk of non-payment for commercial purposes, the risk of non-payment of commission fees to a brokerage firm.

Selective vests The consequences of the wrong choice of the method of investing capital, for example, the type of valuable papers for investment in forming an investment portfolio.

Risks of bankruptcy represent the risk of the organization constantly wasting its capital as a result of the wrong choice of the method of investing capital and the failure to pay off insurance for debts taken.

The receptionist's vest is in a row functions:

function of withdrawing business income for the sake of understanding the favorable situation in the market;

innovative a function that is assumed to be used for the development of innovative products, satisfying the market demand and ensuring the development of products on an innovative basis;

analytical a function that corresponds to the implementation of a necessary government maneuver for the withdrawal of enterprise income at the required moment;

social function, if the risk stimulates the development of the entrepreneurial activities of the enterprise structures, which increases their income, and also the budget income and reduces the level of unemployment.

All officials who add an increasing level of risk to entrepreneurship can be intelligently divided into external and internal ones; objective and subjective; direct and indirect influx.

External factors riziku - the opposite side of the world in relation to the acceptance of the middle, which does not lend itself to flowing from the side of the enterprise. External factors are called objective, so as not to lie behind the enterprise itself:

Tse INFLATSIA, MENTERS, POLITICHIC, SOCIAL-CONONE TO EKOLICHICHICHISIS, MITA, SHISENNA, NUIBILSHIC SHILDSHIC, WIDENSTICTION OF THE ROBOTISTION OF THE WILL EKONOCHICH PIDPRIMNITVVA.

Factory directly infused into the rizik - officials who urgently push the pressure on the economy (change of the feeder system, competition over the market, change of drinking products).

Officials of indirect influx - factors that do not give a direct, direct influx into the country's economy, but rather accommodate its changes (the international situation, the political and foreign economic situation in the region, the economic state of Galusia, etc.).

The analysis of the risk factors external to the enterprise must be carried out entirely in the context of a formal description of its functioning in the minds of real and possible interaction with economic counterparties and media.

Thus, the authorities of Dovkill are pitying themselves in front of the natural-climatic officials; the socio-demographic situation in the region, which means the availability or shortage of labor for various categories of workers, the prestige of this and other professions and activities ; socio-political minds that determine the situation in the region, the level of orientation of the population to productive activity, the level of social tension; I will become a vibrant market as a background for the formation of regional needs for enterprise products; the level of living of the population as a factor in the payment security of this demand; purchasing power of the ruble; dynamics of inflation and inflation rates; the global level of entrepreneurial activity, which characterizes the diversity of people involved in entrepreneurial initiatives.

In the field of general business activity, you can recognize the activities of such external factors, due to the disruption by the business-sellers of the convenient supply schedules for raw materials and component parts, the wholesalers are not motivated to export and pay for the confiscation of finished products, bankruptcy and self-liquidation of the enterprise local counterparties and business partners, in order to ensure the availability of raw materials and finished products to customers.

Internal factors of risk be generated by the industrial-commercial activity of the enterprise, the subjective decisions of its kernels.

The process of creation, creation, development and management has specific factors that can provoke different risks. Before factors responsible for the main virus activity is characterized by an insufficient level of technological discipline, accidents, unplanned problems with equipment or interruption of the technological cycle of production through the impediment of reconfiguration of equipment (for example, due to uncontrolled change and parameters of materials or materials that are used in the technological process).

Officials of the Risik of Additional Virus Activities- due to interruptions in energy supplies, equipment repairs are carried out according to planned terms, failures of additional systems (ventilation devices, water and heat supply systems), lack of preparation of the instrumental state of the enterprise before mastering nya new virus and in.

In the service sector In the process of production processes, risk factors may cause disruptions in the work of services that ensure the uninterrupted functioning of the main and auxiliary production. For example, an accident or fire in the warehouse state will result in the release (increased or frequent) of computational pressures on the information processing system and so on.

The Riks of Creativity The nature of the head rank is connected with the unfunded investment activity of the enterprise and the processes of recruitment, training, retraining and advanced training of personnel.

Internal factors affecting management activities can be classified at the level of decision making: strategic, tactical or operational. Along with the praise for the careful making of strategic decisions, one can see the following internal planning and marketing factors:

The pardon's choice does not adequately formulate the important goals of the enterprise;

The assessment of the strategic potential of the enterprise is incorrect;

Pardon's forecast for the development of the modern enterprise of the ruler's middle class in the long-term perspective and others.

The risk of making a decision on a tactical level is related to the possibility of conflict and frequent loss of local information during the transition from strategic planning to tactical. Since, when developing specific tactical decisions, they did not succumb to the reconsideration of the relevance of the chosen enterprise strategy, then such results, perhaps achieved, may be due to the position of the main strategic direct action business and thus weaken its economic strength.

Such an official can be retained before the officials of indirect influx because there is insufficient capacity to manage the enterprise. At your own expense, it may be equipped with a number of necessary components of a management team, such as teamwork, the ability to work hard, skills in managing people, etc.

Obviously, regardless of the decisions made, there can be both external and internal factors for the enterprise. It can be assumed that in strategic decisions, the strength and role of external government officials is significant, both tactical and operational.